Private Mortgage Investing

Secured Investments

All investments are secured by

real estate in Canada

Monthly Income

Receive your returns in

monthly payments

Stable Returns

Receive the same return

every month

Private Mortgage Investing with Home Credits

All investments are fully secured against real estate. Every property is appraised by an CRA or AACI certified appraiser. Our highly experienced underwriting team reviews each of these investments. A borrower’s situation is analyzed and an exit strategy is crafted for each investment. Our private mortgage investing policy is to be completely transparent to our investors. Therefore, we provide financial statements to our investors, as well as a customer service experience that is unparalleled in the industry.

We thoroughly analyze every application that is submitted to Home Credits. In addition, each deal goes through a thorough screening process before being presented to any of our investors. We work with only hand picked accredited appraisers and real estate lawyers. Therefore, we make sure all the due diligence is completed for you.

With the hot housing markets in areas such as the GTA and Vancouver, many borrowers seek money from Home Credits to purchase homes or bridge gaps in funding. We have a maximum loan-to-value of 75% in certain geographical areas in each province. Home Credits primarily invests in First Mortgages and Second Mortgages located in urban cities. However, we will consider rural locations at a lower loan-to-value of 65% to maximize security.

6-16

% ROI

Investment Experts

Investors Represented

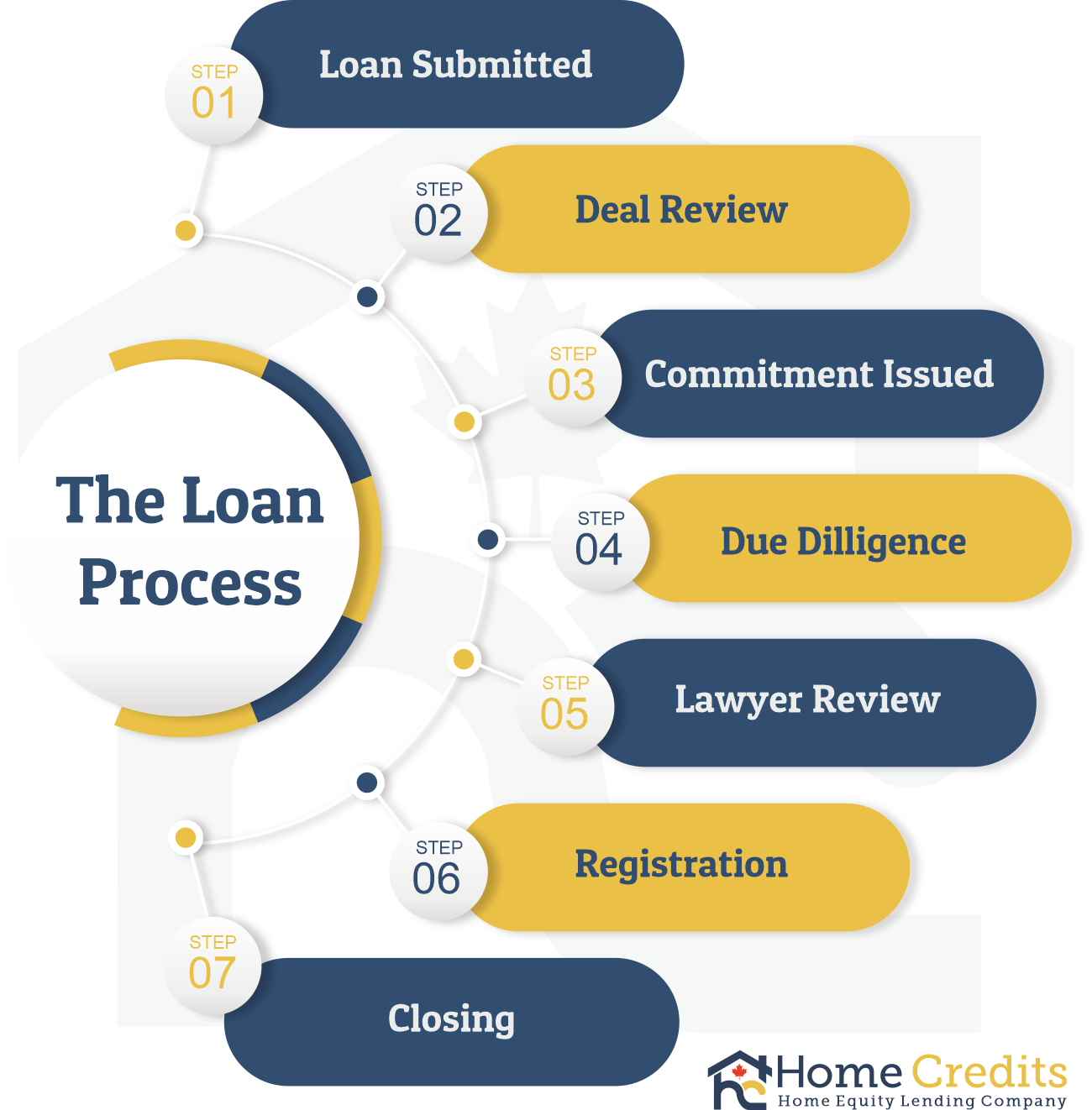

Home Credits Investing Process

Deal Review is performed by experienced underwriters who evaluate and qualify the risk associated with each loan.

Due Diligence is completed by our Investment Directors and fulfillment staff to ensure the loan complies with all government regulations.

Lawyer Review is performed by our legal team. All documents are reviewed and double checked for compliance and security.

Registration and Closing are completed by our legal team. The final closing packages are assembled and the investor is named on the title of the property being used as security.

We Represent the Investor in Every Transaction

Private mortgage investing in Canada has proven to be a successful investment vehicle for decades. Our firm will find mortgage that is best suited to your investment goals/risks. For instance, our average annual ROI to investors are from 6-16% depending on risk tolerance. Home Credits focuses on building long term relationships with our investors and helps them achieve their investment goals. Whether you are a new investor to mortgage investing or an experienced mortgage investor, our firm goes through a consultation process with you to analyze your risk tolerance.

Advantages of Investing With Home Credits

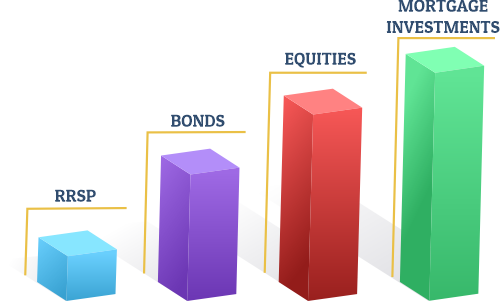

Investors seeking alternatives to traditional equity and fixed-income products choose Private Mortgages and real estate investments to balance their portfolios. Therefore, Home Credits offers investors a portfolio of low-risk first and second mortgages across Canada. Our investment strategies are focused on residential properties. In addition, these properties are located in urban and suburban areas in highly desirable municipalities.

Access to residential mortgage markets not typically available to individuals

Less volatility than equities and more security than bonds

Higher yields than traditional investment products, such as Bonds Mutual Funds and GICs

Stable, reliable monthly income paid directly from the borrower to the investor

Benefits of Private Mortgage Investing

Management:

The Principals of Home Credits have years of mortgage investing and real estate experience.

Diversification:

Investors have the ability to invest in multiple loans as well as desired geographical locations.

Regular Income:

Investors receive their interest payments on a monthly basis.

Real Estate Security:

1st or 2nd mortgage on the subject property. All mortgages are required to have title insurance

RRSP / RRIF / TFSA Eligible:

Self-directed RRSP, TFSA or RRIF are eligible to invest.

Targeted Returns:

Target yield of 6-16%.